Top 6 High-Profit Agribusiness & Animal Husbandry Ideas for Beginners in Nigeria (2025)

A well Detailed practical, data-driven guide for every Nigerians looking to launch a profitable farm business now. I will be covering what’s working, realistic starter options, quick financials, a step-by-step launch plan, and simple 12-month cash flow and break-down worksheet.

Table of Contents

- Introduction

- Small-scale Poultry (Layers or Broilers)

- Fish Farming (Catfish)

- Cassava Processing (Garri): The Value-Add Chain

- Small Zero-Grazing Dairy

- Niche Farming (Snail & Mushroom)

- Beekeeping / Honey Production

- Final Consolidated Summary of All 6 Ventures

- Decision Guide:

-

Introduction

In this practical guide, will take you into a comprehensive guide that will make you to stop just thinking about agriculture—start doing it!

I will take you through what’s working, realistic starter options, quick financials, simple 12-month cash flow and break-down worksheet, and a step-by-step launch plan.

Why Agribusiness in Nigeria is Your Best Bet Now (The Big Picture)

Nigeria’s economy is heavily leaning on agriculture, and that creates massive opportunity for new players:

-

A Solid Economic Pillar: Agriculture contributes a double-digit share of Nigeria's GDP (it made up about 17–25% of GDP across recent quarters in 2023–2024). This ongoing policy focus means support and market attention.

-

Export Windfalls: Non-oil agricultural exports (like cocoa and cashew) are booming. Non-oil exports rose by nearly 20% in the first half of 2025—a clear signal of growing international demand and tailwinds for local farmers and processors.

-

The Demand Gap: Domestic supply can’t meet the demand. For instance, local milk production is less than half of what Nigerians consume, prompting imports and creating a massive, obvious gap buyers will pay to fill.

I am going to rank these business ideas based on ease of start, guaranteed local demand, and speed of return.

-

-

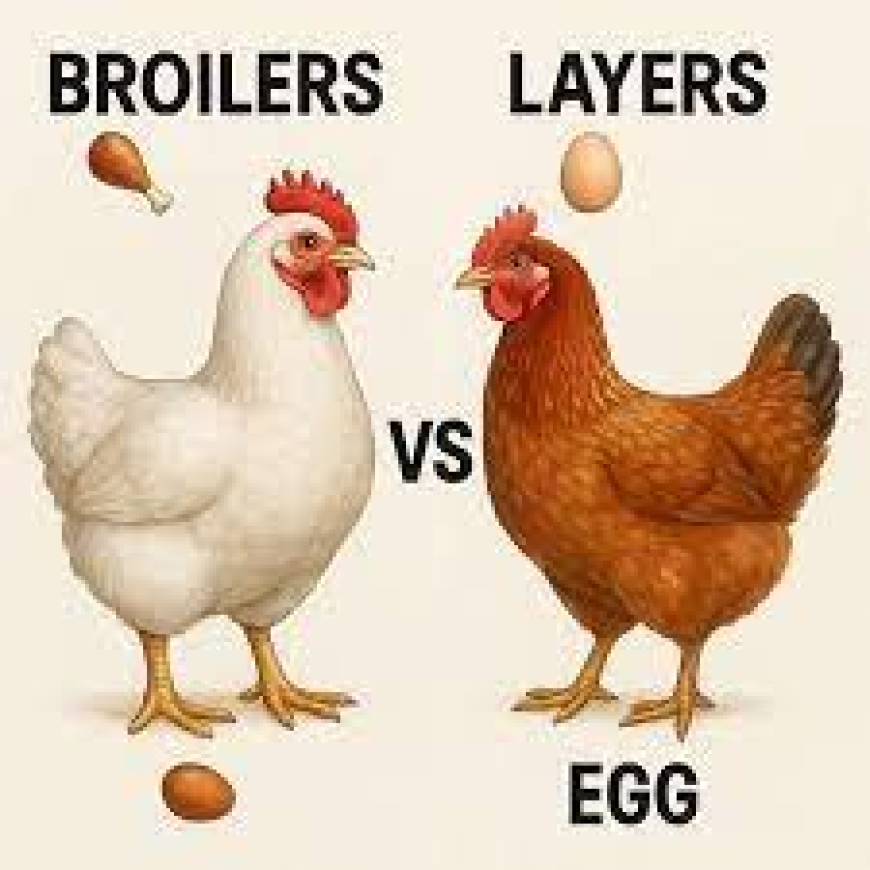

Small-scale Poultry (Layers or Broilers)

Small-scale Poultry (Layers or Broilers) Poultry is a game of numbers and rapid turnover. Your main focus should be in housing, feed, and health management.

Raising chickens for either eggs (Layers) or meat (Broilers).

-

Why It Works for Beginners: It is a best starter pick due to the consistently high and year-round demand for poultry products (eggs and meat) across various markets. The farming techniques are well-documented, making it relatively straightforward to learn.

-

Quick Revenue Cycle:

-

Broilers: Very short cycle of 6–8 weeks from chick to market-ready meat, allowing for multiple turnovers per year.

- Layers: Longer cycle of 18–22 weeks until they reach the point of lay, but then provide a daily revenue stream from egg sales for over a year.

-

-

Startup Cost (Illustrative Range)

-

-

Layers: Longer cycle of 18–22 weeks until they reach the point of lay, but then provide a daily revenue stream from egg sales for over a year.

-

-

Affordable Startup Cost (Illustrative Range): ₦300k – ₦4.5M (for 100–500 birds, excluding land cost, which can vary significantly). Note: The major recurring cost is feed.

Phase Actionable Steps for 100 Birds Critical Success Factor Step 1: Planning & Learning Training: Complete a practical 2-day training or find a mentor. Budget: Get current prices for DOCs (Day-Old Chicks), feed, and vaccines from local suppliers. Commitment to Hygiene: Your plan must revolve around strict cleanliness. Step 2: Housing & Brooding Setup Space: Dedicate a space (e.g., 10ft x 10ft) in your backyard or a small shed. Brooder: Construct a temporary brooding area (circle or corner) within the pen using cardboard or netting. Heat: Install a reliable heat source (brooder lamp or charcoal pot) and check the temperature is 32-35°C (90-95°F) at chick level. Temperature Management: The brooding temperature must be stable. Chicks huddled together means too cold; panting means too hot. Step 3: Stock & Equipment Purchase: Buy 105-110 DOCs (account for 5-10% mortality). Equipment: Buy small feeders, plastic bell drinkers, and place them evenly around the heat source. Litter: Spread 2-3 inches of dry wood shavings. Quality DOCs: Buy from a licensed, reputable hatchery. Never buy cheap, unverified chicks. Step 4: Brooding Management (Week 1) Arrival: Give the chicks sugary water (Glucose/Multivitamins) immediately. Feed: Feed them quality Chick Starter Mash constantly for the first 4 weeks. Medication: Administer anti-stress medication and the first round of vaccines (e.g., Lasota). Access to Water: Chicks must have immediate access to clean water at all times. Check drinkers every few hours. Step 5: Growth & Feed (Weeks 2-8) Feeding Cycle: Switch to Grower Mash (Weeks 4-6), then Finisher Mash (Weeks 6-8). Ventilation: Gradually increase ventilation and remove the brooding structure. Record: Track daily feed consumption and weekly bird weight to calculate Feed Conversion Ratio (FCR). Feed Cost Control: Feed is ~70% of your cost. Minimize wastage by not overfilling feeders and buying in bulk. Step 6: Marketing & Sales Pre-Sale: Contact local food vendors, hotels, and bulk buyers by Week 6. Processing: Decide if you sell live or dressed. Selling: Target the market at 8 weeks for broilers (when the FCR starts to become unprofitable). Market Linkage: Do not wait until the birds are ready to start looking for buyers. -

-

12-Month Financial Model: 500 Layer Bird Poultry Farm

-

Section 1: Initial Start-up Costs (Capital Expenditure - CAPEX)

These are one-time costs incurred before the first batch of revenue.

Item Unit Cost (NGN) Quantity Total Cost (NGN) Notes Day-Old Chicks (DOC) ₦1,200 500 ₦600,000 Budget for good quality, high-yield layers. Housing/Cages ₦150,000 3 ₦450,000 Basic wire/wooden cages (4-tier for 500 birds). Feeder/Drinker System ₦50,000 1 ₦50,000 Manual/semi-automatic system. Vaccinations & Meds (0-5 Months) ₦150 500 ₦75,000 Full schedule up to Point-of-Lay. Miscellaneous (Brooder, Lights, etc.) N/A N/A ₦75,000 Initial setup costs. TOTAL INITIAL CAPEX ₦1,250,000 Initial cash required before operations. -

Section 2: Monthly Operating Costs (Variable & Fixed)

The layers consume Grower Feed from Month 0–5 and switch to Layer Feed from Month 6 onwards (when they begin laying).

Item Months 0–5 (Rearing) Months 6–12 (Laying) Notes Feed Cost ₦160,000/month ₦320,000/month Based on 50kg bag at ₦12,000–₦14,000. Laying birds eat more. Labour ₦40,000/month ₦40,000/month 1 part-time worker salary. Utilities/Maint. ₦10,000/month ₦15,000/month Water, electricity, minor repairs. TOTAL OPERATING COST ₦210,000/month ₦375,000/month Feed is over 85% of cost in the laying phase. -

Section 3: Revenue Projections (From Month 6 Onwards)

We assume a 5-month rearing period and a Point-of-Lay (POL) starting in Month 6.

Metric Assumption Calculation Total Birds 500 initially 450 assumed to reach POL (10% mortality/cull allowance). Peak Lay Rate 85% 450 birds * 85% = 382 eggs/day. Average Daily Eggs 75% 337 eggs/day (Conservative average for the first year). Monthly Egg Production 337 eggs * 30 days 10,110 eggs/month. Average Selling Price (Retail/Crate) ₦70/egg (approx. ₦2,100 per crate of 30) Based on selling to wholesalers/retailers. MONTHLY REVENUE 10,110 eggs * ₦70/egg ₦707,700/month (Gross Revenue) -

Section 4: 12-Month Cumulative Cashflow & Break-Even Analysis

Month Cash In (Revenue) Cash Out (Operating Cost) Net Monthly Cashflow Cumulative Cashflow Status Start-up ₦0 ₦1,250,000 (CAPEX) -₦1,250,000 -₦1,250,000 Investment 1 ₦0 ₦210,000 -₦210,000 -₦1,460,000 Rearing Phase 2 ₦0 ₦210,000 -₦210,000 -₦1,670,000 Rearing Phase 3 ₦0 ₦210,000 -₦210,000 -₦1,880,000 Rearing Phase 4 ₦0 ₦210,000 -₦210,000 -₦2,090,000 Rearing Phase 5 ₦0 ₦210,000 -₦210,000 -₦2,300,000 Total Investment 6 ₦707,700 ₦375,000 ₦332,700 -₦1,967,300 Laying Starts! 7 ₦707,700 ₦375,000 ₦332,700 -₦1,634,600 Profitability 8 ₦707,700 ₦375,000 ₦332,700 -₦1,301,900 Profitability 9 ₦707,700 ₦375,000 ₦332,700 -₦969,200 Profitability 10 ₦707,700 ₦375,000 ₦332,700 -₦636,500 Profitability 11 ₦707,700 ₦375,000 ₦332,700 -₦303,800 Profitability 12 ₦707,700 ₦375,000 ₦332,700 ₦28,900 Break-Even Achieved!

-

-

Key Financial Conclusions

-

Total Initial Cash Outlay (Start-up + Rearing): ₦2,300,000

-

Monthly Operating Profit (from Month 6): ₦332,700

-

Break-Even Point: The business recovers its total investment (CAPEX + Rearing Costs) by Month 12 (specifically 11 months into the laying cycle).

-

Annual Net Cashflow (Year 1): ₦28,900

-

-

-

Fish Farming (Catfish)

Fish Farming (Catfish) Catfish farming, often done in concrete or tarpaulin tanks, is highly scalable. Unlike poultry, your primary focus is water management and hygiene, not the animal itself.

Actionable Focus Critical Success Factor Secure Water Access Your site must have a reliable, clean water source (borehole is best) for daily or weekly water changes. Tank Preparation If building a concrete tank, you MUST cure it for at least 3 weeks using methods like soaking with salt or banana leaves to neutralize the cement's high pH (alkalinity). Failure to do this will kill your fish. Stocking Uniformity Purchase uniform-sized juveniles (6-8 grams) from a trusted source. Size variation leads to cannibalism. Feeding & Observation Use high-quality floating pellets. Feed twice daily, stopping when the fish lose their feeding frenzy (usually 10-15 minutes). Never overfeed; uneaten food fouls the water and depletes oxygen. -

Why It Works for Beginners?

Cassava is a foundational staple food with enormous demand. Processing adds significant value to the raw crop and opens doors to lucrative industrial (for starch) and export markets. You don't necessarily need to be the farmer; you can focus on processing and logistics.

-

Quick Revenue Cycle: Revenue can be ongoing as production is dictated by demand and supply contracts (once established).

-

Example Startup Cost (Illustrative Range): The focus is on acquiring and maintaining essential equipment (grater, press, fryer, mill) and managing the supply logistics of raw tubers. Starting small often involves renting or sharing a processing facility.

-

-

12-Month Financial Model: 1,000 Catfish Fingerlings (Harvest Cycle)

-

Section 1: Initial Start-up Costs (CAPEX & Pre-Cycle Costs)

These costs cover the setup and stocking for the first 6–8 month cycle.

Item Unit Cost (NGN) Quantity Total Cost (NGN) Notes Pond/Tank Construction ₦500,000 1 ₦500,000 Budget for one medium-sized concrete or earthen pond, or two large plastic/tarpaulin tanks. Catfish Fingerlings ₦80 1,000 ₦80,000 Price for 5-6cm fingerlings/juveniles. Quality is critical! Water Pump / Aeration ₦150,000 1 ₦150,000 Basic pump and simple aeration/piping for water management. Medication & Additives N/A N/A ₦20,000 Water treatments, anti-stress agents. TOTAL INITIAL CAPEX ₦750,000 Initial cash required for setup and stocking. -

Section 2: Monthly Operating Costs (Feed is the King)

Catfish feed costs increase monthly as the fish grow. The goal is to reach an average Feed Conversion Ratio (FCR) of 1:1 (1kg of feed produces 1kg of fish).

Item Monthly Cost (NGN) - Average Notes Fish Feed (Variable) ₦120,000/month Highest cost. Estimated average over the 6-month cycle. Uses different pellet sizes (3mm to 9mm). Water/Utilities/Fuel ₦20,000/month Fuel for pumping, electricity for aeration (if used), water changes. Labour ₦30,000/month Part-time management/feeding/cleaning. TOTAL OPERATING COST ₦170,000/month Total Rearing Cost (6 Months) ₦170,000/month x 6 ₦1,020,000 -

Section 3: Revenue Projections (Harvest in Month 7/8)

We assume a 6-month grow-out cycle to reach table size (1kg) and harvest in Month 7.

Metric Assumption Calculation Fingerlings Stocked 1,000 Survival Rate 80% (requires excellent management) 1,000 fish * 80% = 800 fish harvested. Average Harvest Weight 1.0 kg/fish (Table Size) 800 fish * 1.0 kg = 800 kg of fish. Wholesale Price/Kg ₦2,500/kg (Farm Gate Price) Conservative estimate. Retail can be higher (₦3,000–₦3,500/kg). HARVEST REVENUE (Month 7) 800 kg * ₦2,500/kg ₦2,000,000 (Gross Revenue) -

Section 4: 12-Month Cumulative Cashflow & Break-Even Analysis

The model covers one full cycle (Months 1-7) and the start of the next cycle (Months 8-12).

Month Cash In (Revenue) Cash Out (Operating Cost) Net Monthly Cashflow Cumulative Cashflow Status Start-up ₦0 ₦750,000 (CAPEX) -₦750,000 -₦750,000 Investment 1 ₦0 ₦170,000 -₦170,000 -₦920,000 Grow-out Phase 2 ₦0 ₦170,000 -₦170,000 -₦1,090,000 Grow-out Phase 3 ₦0 ₦170,000 -₦170,000 -₦1,260,000 Grow-out Phase 4 ₦0 ₦170,000 -₦170,000 -₦1,430,000 Grow-out Phase 5 ₦0 ₦170,000 -₦170,000 -₦1,600,000 Grow-out Phase 6 ₦0 ₦170,000 -₦170,000 -₦1,770,000 Total Investment to Harvest 7 ₦2,000,000 (Harvest) ₦0 (Harvest Month) ₦2,000,000 ₦230,000 Break-Even Achieved! 8 ₦0 ₦100,000 (Prep & Re-stock) -₦100,000 ₦130,000 Start Cycle 2 9 ₦0 ₦170,000 -₦170,000 -₦40,000 Grow-out Cycle 2 10 ₦0 ₦170,000 -₦170,000 -₦210,000 Grow-out Cycle 2 11 ₦0 ₦170,000 -₦170,000 -₦380,000 Grow-out Cycle 2 12 ₦0 ₦170,000 -₦170,000 -₦550,000 Ending Cash Position

-

-

Key Financial Conclusions

-

Total Investment to First Harvest: ₦1,770,000

-

Monthly Operating Cost: Approximately ₦170,000

-

Break-Even Point: The business recovers its total investment (CAPEX + 6 months of operating cost) immediately upon the first harvest in Month 7.

-

The Power of the Second Cycle: Because the CAPEX is already covered, the second cycle (starting Month 8) will be significantly more profitable, as only the operating costs need to be covered.

-

-

Reflection

Fish farming offers faster capital recovery than the layer farm, but it carries higher risks related to water quality and potential disease outbreaks.

Which area of Catfish farming would you like me to explore next?

-

A detailed list of essential water quality maintenance and biosecurity checks?

-

Strategies for reducing feed costs (the largest expense)?

-

A comparison of the financial risk between the Poultry and Catfish models?

Drop it on the comments section

-

-

-

Cassava Processing (Garri): The Value-Add Chain

Moving from farming to processing secures higher profit margins. Success here relies on supply chain consistency and product quality.

Actionable Focus Critical Success Factor Secure Raw Material Before buying equipment, establish contracts with 5-10 local cassava farmers for consistent supply. This prevents equipment sitting idle. Equipment Minimums Acquire a functional, heavy-duty Grater, a Hydraulic Press (for de-watering), and a simple Garri Fryer (Igba-Garri). Quality Control Stick to a fixed fermentation period (typically 2-3 days) for your mash. This ensures flavor consistency and proper detoxification. Frying & Packaging Fry the garri until its moisture content is very low. Package the final product in clean, branded bags to appeal to wholesalers and command a premium price. Hygiene is non-negotiable. -

Why It Works for Beginners?

Cassava is a foundational staple food with enormous demand. Processing adds significant value to the raw crop and opens doors to lucrative industrial (for starch) and export markets. You don't necessarily need to be the farmer; you can focus on processing and logistics.

-

Quick Revenue Cycle: Revenue can be ongoing as production is dictated by demand and supply contracts (once established).

-

Example Startup Cost (Illustrative Range): The focus is on acquiring and maintaining essential equipment (grater, press, fryer, mill) and managing the supply logistics of raw tubers. Starting small often involves renting or sharing a processing facility.

-

-

12-Month Financial Model: Small-Scale Garri Processing Unit

-

Section 1: Initial Start-up Costs (Capital Expenditure - CAPEX)

This model assumes you buy raw tubers from farmers (no land cost) and require basic motorized equipment.

Item Unit Cost (NGN) Quantity Total Cost (NGN) Notes Grating Machine (Motorized) ₦450,000 1 ₦450,000 Medium-duty, mobile or fixed. Pressing Jack/Machine ₦150,000 2 ₦300,000 For de-watering the grated mash. Frying Pan (Industrial) ₦50,000 4 ₦200,000 Large, fabricated pans + firewood/gas setup. Sieving/Peeling Utensils N/A N/A ₦50,000 Includes industrial buckets, sieves, trays. Infrastructure/Shed N/A N/A ₦200,000 Basic open shed for processing and storage. Generator (Small) ₦300,000 1 ₦300,000 Essential for reliable grating power. TOTAL INITIAL CAPEX ₦1,500,000 Initial cash required for equipment and setup. -

Section 2: Monthly Operating Costs (Variable Raw Material Focus)

We assume a target throughput of 15,000 kg of Garri per month (approximately 500 kg per day for 30 days).

Item Monthly Cost (NGN) Calculation/Notes Raw Cassava Tubers ₦3,000,000 Highest cost. Assumes ₦40/kg for tubers. Requires ~60,000 kg of tubers (4:1 conversion ratio). Labour ₦350,000 5–7 workers (peeling, grating, frying, packaging). Fuel/Firewood/Utilities ₦150,000 Fuel for generator, firewood/gas for frying, maintenance. Packaging Materials ₦100,000 Sacks/nylon bags, labels, transportation costs. TOTAL OPERATING COST ₦3,600,000/month Raw material dictates profitability here. -

Section 3: Revenue Projections (Consistent Monthly Production)

Metric Assumption Calculation Garri Conversion Ratio 4:1 4 kg of raw cassava yields 1 kg of finished garri. Monthly Garri Production 60,000 kg (tubers) / 4 15,000 kg of Garri. Selling Price (Wholesale/Kg) ₦300/kg Conservative farm gate/wholesale price. MONTHLY REVENUE 15,000 kg * ₦300/kg ₦4,500,000/month (Gross Revenue) Monthly Gross Profit Revenue - Operating Cost ₦4,500,000 - ₦3,600,000 = ₦900,000 -

Section 4: 12-Month Cumulative Cashflow & Break-Even Analysis

In this model, the equipment purchase is in Month 0, and consistent production begins in Month 1.

Month Cash In (Revenue) Cash Out (Operating Cost) Net Monthly Cashflow Cumulative Cashflow Status Start-up ₦0 ₦1,500,000 (CAPEX) -₦1,500,000 -₦1,500,000 Investment 1 ₦4,500,000 ₦3,600,000 ₦900,000 -₦600,000 1st Production 2 ₦4,500,000 ₦3,600,000 ₦900,000 ₦300,000 Break-Even Achieved! 3 ₦4,500,000 ₦3,600,000 ₦900,000 ₦1,200,000 Profitability 4 ₦4,500,000 ₦3,600,000 ₦900,000 ₦2,100,000 Profitability 5 ₦4,500,000 ₦3,600,000 ₦900,000 ₦3,000,000 Profitability 6 ₦4,500,000 ₦3,600,000 ₦900,000 ₦3,900,000 Profitability 7 ₦4,500,000 ₦3,600,000 ₦900,000 ₦4,800,000 Profitability 8 ₦4,500,000 ₦3,600,000 ₦900,000 ₦5,700,000 Profitability 9 ₦4,500,000 ₦3,600,000 ₦900,000 ₦6,600,000 Profitability 10 ₦4,500,000 ₦3,600,000 ₦900,000 ₦7,500,000 Profitability 11 ₦4,500,000 ₦3,600,000 ₦900,000 ₦8,400,000 Profitability 12 ₦4,500,000 ₦3,600,000 ₦900,000 ₦9,300,000 Annual Net Cashflow

-

-

Key Financial Conclusions

-

Total Initial Cash Outlay (CAPEX): ₦1,500,000

-

Monthly Gross Profit: ₦900,000

-

Break-Even Point: The business recovers its equipment investment by Month 2 of operation. This quick recovery is a major advantage of processing units.

-

Vulnerability: This business is highly sensitive to the price and reliable supply of raw cassava tubers. A shortage or a price spike in tubers can immediately erase profit margins.

-

-

Financial Summary Reflection

You now have high-level financial models for three diverse, high-potential ventures:

-

Layers (500 Birds): High total investment, high running cost (feed), slow revenue start, Break-Even in Month 12. Lower operational complexity.

-

Catfish (1,000 Fish): Medium investment, very high running cost (feed), bulk revenue at harvest, Break-Even in Month 7. High technical complexity (water quality).

-

Garri Processing (Small Unit): Medium investment (CAPEX), fast and large recurring revenue, Break-Even in Month 2. Profit is tied to raw material sourcing.

To help you decide, would you like a final comparison on the Risk vs. Return profile of all three options?

-

-

-

Small Zero-Grazing Dairy

Zero-grazing (bringing feed to the cow) is intensive but maximizes yield from limited land. The cow is an asset; its feed is its fuel.

Actionable Focus Critical Success Factor Establish a Fodder Bank Crucial Step: Dedicate land to growing high-yield forage (Napier grass, lucerne). You must have a continuous supply of feed before you buy the cow. Housing Design Construct a clean, well-drained shed with a separate, dry resting area and a solid concrete milking/walking area. Good drainage prevents disease. Stock Selection Buy 1-2 freshly lactating or pregnant high-yield cross-bred cows (e.g., Friesian/Sahiwal). A poor cow will consume your feed for little yield. Rigid Routine Establish and adhere to a fixed daily schedule for milking (e.g., 6 AM and 5 PM) and feeding. Consistency minimizes stress and maximizes milk production. -

Why It Works for Beginners

-

There is a significant high-demand shortfall for domestically produced fresh milk. The zero-grazing model is ideal for areas with limited land space, allowing for intensive management and better health control. It is often supported by government initiatives to boost local dairy output.

-

Quick Revenue Cycle: Generates daily milk sales, providing excellent cash flow.

-

Example Startup Cost (Illustrative Range): The primary focus is on purchasing a high-yield breed of cow and establishing a sustainable feed strategy (e.g., planting grass/forage crops) and housing. Initial capital is substantial for the quality breed.

-

-

12-Month Financial Model: Small Zero-Grazing Dairy Unit (5 Cows)

-

Section 1: Initial Start-up Costs (Capital Expenditure - CAPEX)

These costs are upfront and specialized. Since the zero-grazing model requires intensive care, housing and breed quality are paramount.

Item Unit Cost (NGN) Quantity Total Cost (NGN) Notes High-Yield Dairy Cows ₦750,000 5 ₦3,750,000 Budget for quality pregnant/calved cows (e.g., Friesian/cross-breeds). Zero-Grazing Shed/Pens N/A N/A ₦1,000,000 Housing with feed troughs, water, and waste drainage (essential infrastructure). Milking Equipment/Pails N/A N/A ₦150,000 Basic equipment, cooling tank (if scaling) or churns. Initial Vet & Vaccines N/A N/A ₦100,000 Deworming, vaccinations, necessary medications. Land Lease/Purchase N/A N/A ₦500,000 Estimated annual lease for a small plot (if not owned). TOTAL INITIAL CAPEX ₦5,500,000 Highest initial investment of all models. -

Section 2: Monthly Operating Costs (Feed/Forage Focus)

This assumes all five cows are producing milk (e.g., three milking, two dry/pregnant) or are phased in within the first year.

Item Monthly Cost (NGN) Notes Concentrate Feed/Supplements ₦450,000/month Dairy mash, mineral licks, and supplements. Essential for high yield. Forage/Hay Supply ₦150,000/month Purchasing chopped napier grass or silage/hay, if not grown on-site. Labour ₦80,000/month One dedicated farmhand for feeding, cleaning, and milking. Utilities/Vet ₦50,000/month Water, electricity, and routine monthly veterinary checks. TOTAL OPERATING COST ₦730,000/month High and consistent monthly operational expense. -

Section 3: Revenue Projections (Daily Cashflow)

We assume an average yield of 8 litres per cow per day for the cows that are milking (estimated 3 out of 5 milking on average).

Metric Assumption Calculation Cows Milking (Average) 3 cows Assumes phased calving and dry periods. Average Daily Yield 8 Litres/cow/day 3 cows $\times$ 8L = 24 Litres/day. Monthly Milk Production 24L $\times$ 30 days 720 Litres/month. Selling Price (Wholesale/Litre) ₦1,500/Litre Selling to local collectors, restaurants, or directly to consumers (higher value). MONTHLY REVENUE 720 Litres $\times$ ₦1,500/Litre ₦1,080,000/month (Gross Revenue) Monthly Gross Profit Revenue - Operating Cost ₦1,080,000 - ₦730,000 = ₦350,000 -

Section 4: 12-Month Cumulative Cashflow & Break-Even Analysis

In this model, revenue begins immediately (Month 1), assuming the cows were bought already producing or about to produce.

Month Cash In (Revenue) Cash Out (Operating Cost) Net Monthly Cashflow Cumulative Cashflow Status Start-up ₦0 ₦5,500,000 (CAPEX) -₦5,500,000 -₦5,500,000 Initial Investment 1 ₦1,080,000 ₦730,000 ₦350,000 -₦5,150,000 Production Starts 2 ₦1,080,000 ₦730,000 ₦350,000 -₦4,800,000 Steady Cashflow ... ... ... ... ... ... 10 ₦1,080,000 ₦730,000 ₦350,000 -₦2,000,000 11 ₦1,080,000 ₦730,000 ₦350,000 -₦1,650,000 12 ₦1,080,000 ₦730,000 ₦350,000 -₦1,300,000 End of Year 1 Cash

-

-

Key Financial Conclusions

-

Total Initial Cash Outlay (CAPEX): ₦5,500,000

-

Monthly Operating Profit: ₦350,000

-

Break-Even Point: This business has the longest cash recovery period. At ₦350,000 net profit per month, it would take roughly 16 months ($5,500,000 / 350,000) of sustained operation to break even on the initial investment.

-

Major Advantage: Daily, reliable revenue and the cow itself (the asset) increases in value and produces calves (additional assets).

-

-

Comparison: Risk vs. Return Profiles

Here is a summary of all four models to help you decide which opportunity best matches your capital, patience, and risk tolerance:

Venture Initial CAPEX (Illustrative) Time to Revenue Start Time to Break-Even (Approx.) Primary Cost Risk Key Operational Challenge Garri Processing ₦1.5 M Immediate (Month 1) Month 2 Raw Material Supply/Price Sourcing and Logistics of Tubers Catfish Farming ₦0.75 M Delayed (Month 7) Month 7 (Upon harvest) Feed Cost & Mortality Water Quality and Disease Control Layer Poultry ₦1.25 M Delayed (Month 6) Month 12 Feed Cost (Volatility) Biosecurity and Disease Management Dairy Farming ₦5.5 M Immediate (Month 1) Month 16+ Specialized Feed/Forage Cost Veterinary Care and Breed Management

-

-

Niche Farming (Snail & Mushroom)

Niche Farming (Snail & Mushroom) These are low-capital, low-space ventures that thrive on premium markets. Both rely on you mastering environmental control.

Actionable Focus (Mushroom) Critical Success Factor (Mushroom) Sterilization Focus Secure a clean, dark room and learn substrate sterilization techniques (usually steam). Contamination is the number one cause of failure. Spawn Inoculation Purchase quality mushroom spawn (Oyster is easiest) and inoculate the sterile bags in the cleanest possible environment to prevent mold. Actionable Focus (Snail) Critical Success Factor (Snail) Snailery Construction Build a secure pen (hutch, trench, or tires) in a cool, shady spot, and ensure it is predator-proof (especially against rats). Calcium Supply Stock your pen with rich, loose soil and consistently provide a readily available calcium source (crushed eggshells, limestone) to ensure strong shell development. -

Why It Works for Beginners

-

These are niche markets that require very low capital and an extremely small footprint (can be done in a backyard or garage). They yield high unit prices/margins for the finished product.

-

Quick Revenue Cycle: Short cycles for mushrooms (often weeks) offer fast returns, while snails have a longer cycle (6–12 months) but minimal daily input.

-

Example Startup Cost (Illustrative Range): Requires low initial capital. The cost is mainly for constructing the snailery/mushroom house and buying initial stock (snails) or spawn and substrate (mushrooms).

-

-

12-Month Financial Model: Niche Farming (Snail & Mushroom)

-

Section 1: Initial Start-up Costs (Capital Expenditure - CAPEX)

These costs cover the basic housing structures needed for these specialty crops.

Item Unit Cost (NGN) Quantity Total Cost (NGN) Notes Snail Pen Construction ₦50,000 2 ₦100,000 Wooden/block pens with mesh cover for 500 snails. Mushroom Shed/Rack System N/A N/A ₦150,000 Small, dark, humid structure with shelves/racks for substrate bags. Breeder Snails (Achatina Marginata) ₦1,500 50 ₦75,000 Initial stock of good adult snails. Sprayers/Hygrometers N/A N/A ₦25,000 Tools for maintaining high humidity (essential). TOTAL INITIAL CAPEX ₦350,000 Lowest initial investment of all models. -

Section 2: Monthly Operating Costs (Low and Specialized)

Mushroom farming requires a new substrate (bagged waste) monthly, while snail farming has very low recurring costs.

Item Monthly Cost (NGN) Notes Mushroom Substrate/Spawn ₦60,000/month Purchasing new, inoculated bags for continuous harvest. Labour ₦30,000/month Part-time attention to watering and harvesting. Snail Feed/Supplements ₦10,000/month Primarily leaves, fruits, and calcium powder (very low cost). Utilities/Maint. (Water) ₦10,000/month Water for humidity control and general cleaning. TOTAL OPERATING COST ₦110,000/month Very low monthly operational expense. -

Section 3: Revenue Projections (Phased Start)

We assume Mushroom harvest begins in Month 2 due to the very fast cycle (4–8 weeks) and Snail harvest begins in Month 7 (requires 6–7 months to grow from hatchlings).

Mushroom Revenue (Months 2-12):

-

Monthly Production: 100 kg (from consistent cycling of substrate).

-

Selling Price (Wholesale): ₦2,500/kg.

-

Monthly Revenue (Mushroom): 100 kg $\times$ ₦2,500/kg = ₦250,000

Snail Revenue (Month 7 Harvest):

-

Snails Harvested: 50 breeders produce ~500 market-size snails (conservative 10:1 yield).

-

Selling Price (Wholesale): ₦1,200/snail.

-

Bulk Revenue (Snail - Month 7): 500 snails $\times$ ₦1,200/snail = ₦600,000 (This will be a recurring harvest every 6-7 months).

-

-

Section 4: 12-Month Cumulative Cashflow & Break-Even Analysis

Month Cash In (Revenue) Cash Out (Operating Cost) Net Monthly Cashflow Cumulative Cashflow Status Start-up ₦0 ₦350,000 (CAPEX) -₦350,000 -₦350,000 Investment 1 ₦0 ₦110,000 -₦110,000 -₦460,000 Preparing Substrate & Hatching 2 ₦250,000 ₦110,000 ₦140,000 -₦320,000 Mushroom Harvest Starts 3 ₦250,000 ₦110,000 ₦140,000 -₦180,000 Continuous Mushroom Income 4 ₦250,000 ₦110,000 ₦140,000 -₦40,000 Near Break-Even 5 ₦250,000 ₦110,000 ₦140,000 ₦100,000 Break-Even Achieved! 6 ₦250,000 ₦110,000 ₦140,000 ₦240,000 Profitability 7 ₦850,000 (Mushroom + Snail Harvest) ₦110,000 ₦740,000 ₦980,000 First Snail Bulk Revenue 8 ₦250,000 ₦110,000 ₦140,000 ₦1,120,000 Profitability 9 ₦250,000 ₦110,000 ₦140,000 ₦1,260,000 Profitability 10 ₦250,000 ₦110,000 ₦140,000 ₦1,400,000 Profitability 11 ₦250,000 ₦110,000 ₦140,000 ₦1,540,000 Profitability 12 ₦250,000 ₦110,000 ₦140,000 ₦1,680,000 Annual Net Cashflow

-

-

Key Financial Conclusions

-

Total Initial Cash Outlay (CAPEX): ₦350,000 (The lowest of all 5 models).

-

Mushroom Advantage: Provides immediate, reliable cashflow starting in Month 2.

-

Snail Advantage: Provides large bulk revenue every 6-7 months.

-

Break-Even Point: The business recovers its total investment by Month 5 through steady mushroom sales, long before the first snail harvest.

-

-

Niche Model Summary

Niche farming offers the best profile for an entrepreneur with low capital and limited space (e.g., in an urban backyard or rented space). The financial performance is strong due to low operational costs and high unit pricing for the specialty products.

Venture Initial CAPEX (Illustrative) Time to Break-Even (Approx.) Primary Risk Key Advantage Snail & Mushroom ₦0.35 M Month 5 Technical Skill (Humidity/Hygiene) Lowest Barrier to Entry; Fastest Recurring Cashflow Start

-

-

Beekeeping / Honey Production

Beekeeping / Honey Production Beekeeping requires minimal daily labor but relies heavily on your initial site selection and respecting the bees' nature.

-

Why It Works for Beginners

-

Offers a very low cost of entry and has a small physical footprint (the hives themselves). You benefit from multiple profitable products (honey, beeswax, propolis, royal jelly).

-

Quick Revenue Cycle: Honey harvesting is typically an annual harvest (though sometimes twice a year), which means the cash cycle is longer, but the initial daily labor is minimal.

-

Example Startup Cost (Illustrative Range): The cost primarily covers the initial purchase or construction of hives, bee attractant (bait), and essential protective gear and basic processing tools.

-

-

12-Month Financial Model: Beekeeping & Honey Production (10 Hives)

-

Section 1: Initial Start-up Costs (Capital Expenditure - CAPEX)

The majority of the cost is in setting up the initial hive infrastructure and protective gear.

Item Unit Cost (NGN) Quantity Total Cost (NGN) Notes Langstroth Beehives (Complete) ₦35,000 10 ₦350,000 Good quality, durable boxes. Colony/Swarm Acquisition ₦15,000 10 ₦150,000 Cost to acquire/capture the initial bee colonies. Protective Suit & Tools ₦50,000 2 ₦100,000 Suits, gloves, smoker, hive tool. Honey Extractor (Manual) ₦150,000 1 ₦150,000 A single extractor can serve many small farms. TOTAL INITIAL CAPEX ₦750,000 Moderate initial investment, mostly for equipment. -

Section 2: Monthly Operating Costs (Extremely Low)

Bees are generally self-sufficient, meaning feed costs are only necessary during severe dry/drought seasons (which we will budget for).

Item Monthly Cost (NGN) Notes Supplementary Feed/Sugar ₦10,000/month Budget for feeding during scarcity or establishment phase. Labour ₦20,000/month Part-time maintenance, inspections, and cleaning. Jarring/Packaging Materials ₦10,000/month Small jars, labels, and sealing material. Utilities/Maint. ₦5,000/month Tool maintenance, water source checks. TOTAL OPERATING COST ₦45,000/month The lowest consistent monthly cost among all models. Total Annual Running Cost ₦45,000/month x 12 ₦540,000 -

Section 3: Revenue Projections (Harvest in Month 10)

Beekeeping typically allows for one major annual harvest and one minor harvest. We focus on the major harvest in Month 10.

Metric Assumption Calculation Hives Stocked 10 hives Average Yield/Hive (Annual) 15 Litres/hive Conservative yield for the first year. Total Honey Production (Liters) 10 hives $\times$ 15 Litres 150 Litres of Honey. Selling Price (Retail/Litre) ₦5,000/Litre Selling raw, unfiltered honey directly to consumers. Ancillary Revenue (Wax/Propolis) N/A ₦100,000 (Estimate for wax, propolis, and hive splits). TOTAL ANNUAL REVENUE (Month 10) (150L $\times$ ₦5,000) + ₦100,000 ₦850,000 (Bulk Revenue) -

Section 4: 12-Month Cumulative Cashflow & Break-Even Analysis

In this model, the initial CAPEX is spread over 12 months, and the bulk revenue hits in Month 10.

Month Cash In (Revenue) Cash Out (Operating Cost) Net Monthly Cashflow Cumulative Cashflow Status Start-up ₦0 ₦750,000 (CAPEX) -₦750,000 -₦750,000 Investment 1–9 (Cumulatively) ₦0 ₦45,000 $\times$ 9 -₦405,000 -₦1,155,000 Passive Maintenance Phase 10 ₦850,000 (Harvest) ₦45,000 ₦805,000 -₦350,000 Bulk Revenue Hits 11 ₦0 ₦45,000 -₦45,000 -₦395,000 Post-Harvest Maintenance 12 ₦0 ₦45,000 -₦45,000 -₦440,000 End of Year 1 Cash

-

-

Key Financial Conclusions

-

Total Initial Investment (CAPEX + Annual Run Cost): ₦1,290,000

-

Monthly Operating Cost: The lowest among all models at ₦45,000.

-

Break-Even Point: This business does not break even in Year 1. The final cash balance is -₦440,000.

-

Major Advantage: The loss is small relative to the cash used. In Year 2, with CAPEX zeroed out and a higher yield, the farm will generate a large profit. Beekeeping is a long-term asset-building venture. The number of hives (the asset) will also double or triple in Year 2, providing compounding growth.

-

-

-

Final Consolidated Summary of All 6 Ventures

Here is a side-by-side comparison of all the models to guide your final decision:

Venture Initial CAPEX (Illustrative) Time to Revenue Start Time to Break-Even (Approx.) Primary Cost Risk Snail & Mushroom ₦0.35 M Month 2 Month 5 Technical Skill/Hygiene Garri Processing ₦1.5 M Month 1 Month 2 Raw Material Supply/Price Catfish Farming ₦0.75 M Month 7 Month 7 (Upon harvest) Feed Cost & Mortality Layer Poultry ₦1.25 M Month 6 Month 12 Feed Cost (Volatility) Beekeeping ₦0.75 M Delayed (Month 10) Year 2 (Month 16-18) Colony Health/Swarming Dairy Farming ₦5.5 M Month 1 Year 2 (Month 16+) Specialized Feed/Forage Cost -

Decision Guide:

-

Lowest Capital/Fastest Cashflow: Snail & Mushroom

-

Quickest CAPEX Recovery: Garri Processing

-

Highest Passive Income (Long-Term): Beekeeping (from Year 2 onwards)

-